To get this new rule, you divide 100 by the IWR: 100 / 3 = 33. Changing the percentage you initially withdraw impacts how much you need to save to fund the same income in retirement.įor example, if we decrease the IWR to 3%, the 25x Rule becomes the 33x Rule. If you’re concerned about rising inflation or low investment returns or you have a more conservative portfolio, you may want to withdraw a smaller percentage of your portfolio each year. The 4% Rule is based on an initial withdrawal rate (IWR) of 4%. But you may feel comfortable withdrawing more (or less) from your portfolio in retirement. Four percent of $1.25 million in our example above is $50,000, the amount we needed in retirement in our hypothetical. We get the 25x Rule from the 4% Rule because if you multiply 4% of something by 25, you will get 100% of the original value. Yet it’s still viewed as a very safe approach to retirement spending. It’s possible that future markets and inflation could deplete a portfolio that follows the rule in under 30 years. Of course, the 4% Rule isn’t a guarantee. The term “4% Rule” is a little misleading, though, because it’s based on you withdrawing 4% in year one of retirement and adjusting subsequent annual withdrawals by the rate of inflation. In a 1994 paper, William Bengen, certified financial planner, used historical market and inflation data to determine that a retiree could withdraw 4% of their portfolio without running out of money over a 30-year retirement. You’re able to safely withdraw this amount without depleting your portfolio early thanks to another personal finance guideline, the 4% Rule. And keep in mind that depending on the type of account the money is withdrawn from, you may owe income or capital gains tax.

According to the 25x Rule, you would need to save at least $1.25 million to be able to safely withdraw $50,000 of income in your first year of retirement. In this scenario, Social Security, pensions, a part-time job or other sources of income cover $25,000 of this amount, so you must cover the remaining $50,000 with your investments. It works by estimating the annual retirement income you expect to provide from your own savings and multiplying that number by 25.įor example, let’s assume you’ve settled on a retirement budget of $75,000 a year. The 25x Rule is a way to estimate how much money you need to save for retirement. This useful rule of thumb can give you a high-level view of your retirement needs as you begin developing your retirement plan. Planning for retirement involves countless considerations, from deciding when to take Social Security to paying for healthcare and managing retirement accounts. To find out more, please contact us here.The 25x Rule helps you estimate the total amount of money you need to save for retirement. You can print the output of this planner and share it with your clients.

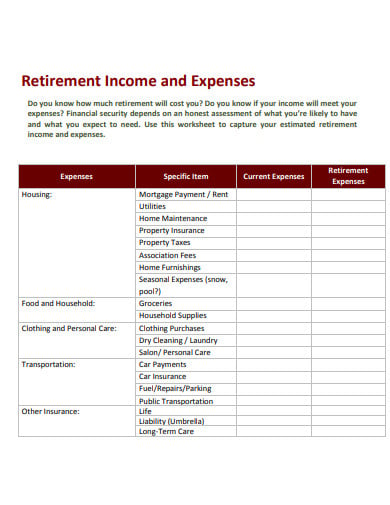

This will help them with their retirement income planning. In addition to identifying any income surplus or shortfall, it also gives an indication of your clients chances of living to certain ages based on their assessment of their health. You can either enter the total amount, or add them individually by clicking ‘Edit’.

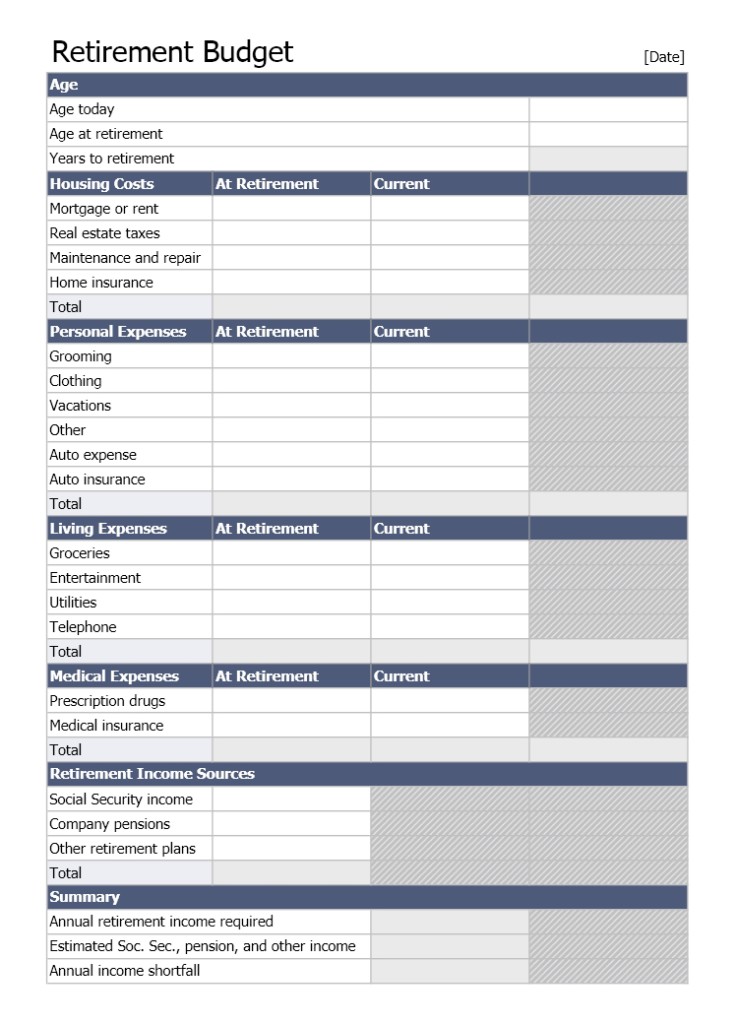

Choose the expenditure profile to match your clients circumstances or create a custom one.Our retirement budget planner allows your clients to see their expected income, monthly expenses and identify any surplus or shortfall. Helping your clients identify income sources and expected outgoings during retirement means they can determine their monthly minimum income need.

0 kommentar(er)

0 kommentar(er)